Making the Most of Your Employer-Provided Benefits

Choosing your employer-provided benefits can feel overwhelming. With so many options—and often only a short enrollment window—it’s not always easy to know which benefits are the right fit for your own unique personal needs, today and in the future.

From health and life insurance to retirement plans and flexible spending accounts, each decision can have either an immediate or lasting (or both!) impact on your finances, your protection, and your overall well-being. That’s why it’s important to take a thoughtful moment to step back and think strategically about your choices.

The temptation may very well be to simply get through the task and get it off your plate. But the extra time and effort to make these choices wisely today will have benefit that redounds to your family’s future for years to come.

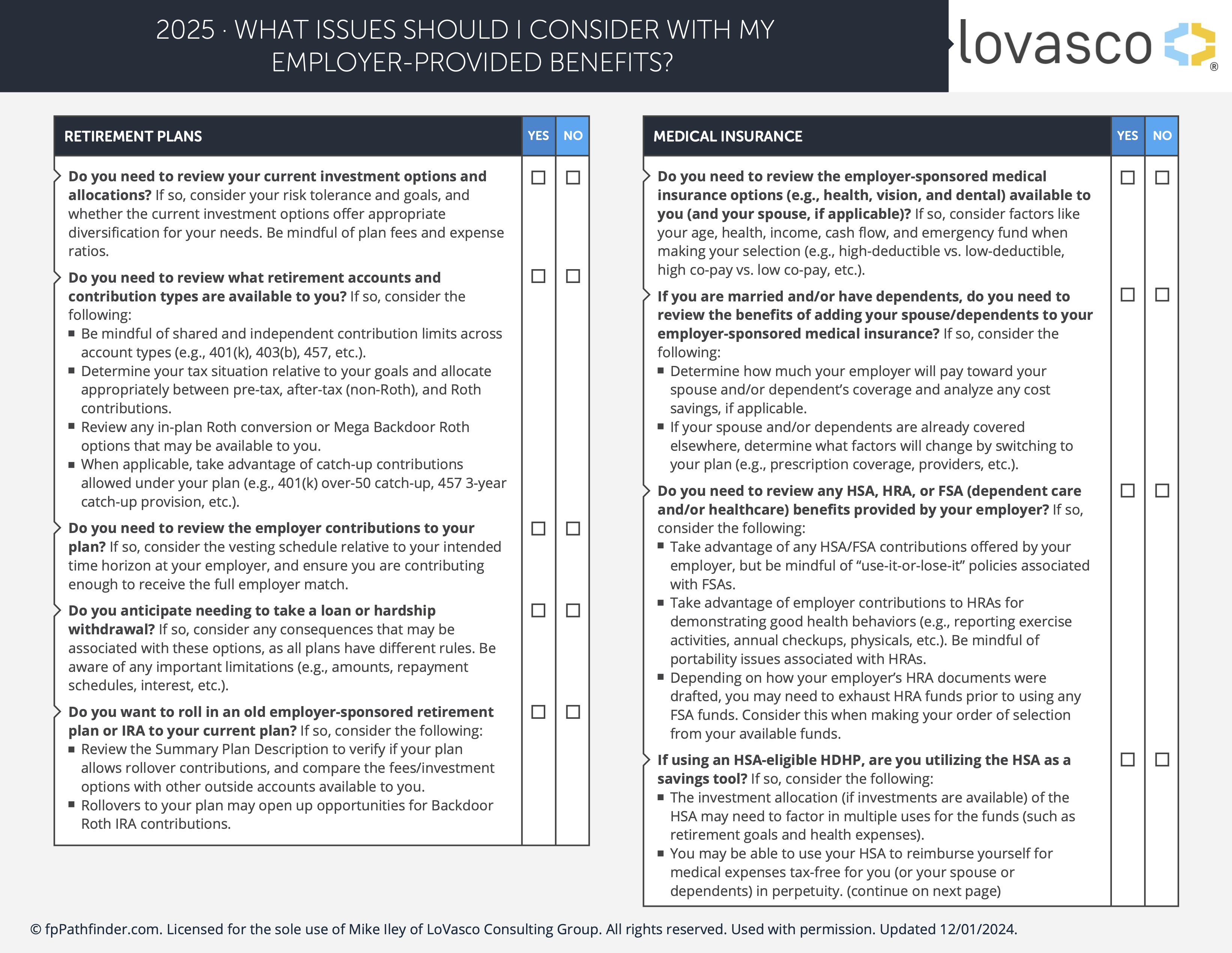

The helpful checklist, “What Issues Should I Consider With My Employer-Provided Benefits?”, is designed to help you evaluate your options and make informed decisions that align with your goals.

Key Areas to Review

When utilizing this tool, use the following as your guidance:

1. Medical Insurance

Whether it’s health, vision, or dental, your employer’s medical benefits should be evaluated for coverage, costs, and compatibility with your needs.

- Compare plan types (high-deductible vs. low-deductible, high co-pay vs. low co-pay) based on your expected health care usage.

- If you’re married or have dependents, determine whether adding them to your plan or keeping them on their own coverage makes more sense financially and in terms of provider access.

- Review health-related savings options like HSAs, HRAs, and FSAs to maximize employer contributions and tax benefits.

2. Retirement Plans

Employer-sponsored plans like 401(k)s, 403(b)s, or 457 plans can be cornerstones of your long-term financial security.

- Understand your investment options, contribution limits, and whether Roth contributions or in-plan conversions are available.

- Take full advantage of employer matching contributions and be aware of vesting schedules.

- If you have old retirement accounts, compare fees and investment choices to see if rolling them into your current plan makes sense.

3. Life and Disability Insurance

Employer-provided life and disability insurance can be cost-effective ways to secure coverage, especially if you have health issues that make individual coverage more expensive or harder to obtain.

- Make sure coverage amounts are adequate for your needs.

- Be mindful of portability—what happens to your coverage if you change jobs?

- For disability insurance, understand the waiting period, definition of disability, and whether benefits are taxable.

4. Additional and Fringe Benefits

Beyond the basics, many employers offer stock options, student loan assistance, parental leave, mental health services, and other perks.

- Review the details of these benefits and prioritize using them, especially if they offset costs you would otherwise pay out of pocket.

- If you receive stock options or RSUs, understand their vesting schedules, tax implications, and long-term planning considerations.

Knowledge Is Power

Your employer benefits are more than a list of perks; they are a powerful part of your overall financial plan. The first step is understanding everything that your employer is making available to you, then asking about things you may wish to pursue but don’t see offered. Coordinating these benefits with your savings, investment strategy, and protection needs can help you get the most value while minimizing gaps in coverage.

Download the checklist today to make your next benefit elections with confidence. A little extra time, thought, and strategy now could lead to big financial advantages down the road. Once you've completed it, we’d be happy to walk through your results and discuss ways to to optimize your employee benefits offerings as part of your overall future planning.

Is Your Retirement Plan Consultant Actually Doing Their Job?

Take the Self-Assessment to Find Out.

You're responsible for your company’s retirement plan. But with shifting regulations, mounting fiduciary risks, and growing employee expectations, how do you know if you have the right fiduciary oversight and financial wellness process in place?

It takes just 3 minutes

It’s completely free

Receive customized results instantly

Not sure where to start?

15 Questions to Score Your Organization's Benefit Program

See what you are missing.

Confirm where you shine.

Track progress over time.

Not sure where to start?

20 Questions to Score Your Organization's Employee Communications Strategy

See what you are missing.

Confirm where you shine.

Track progress over time.

Subscribe to Our Insights Blog

Receive the latest articles from LoVasco's team of experienced experts on employee benefits and retirement plan best practices.