Issues to Consider Now, Before the End-of-Year Gets Here

As we soon head into the 4th Quarter (can you believe it?!), now is an ideal time to pause and take stock of your financial picture, before the end-of-the-year distractions and obligations begin to pile up. The weeks leading up to December 31st bring several planning opportunities—and deadlines—both of which can help you reduce taxes, optimize savings, and start the new year in a stronger position.

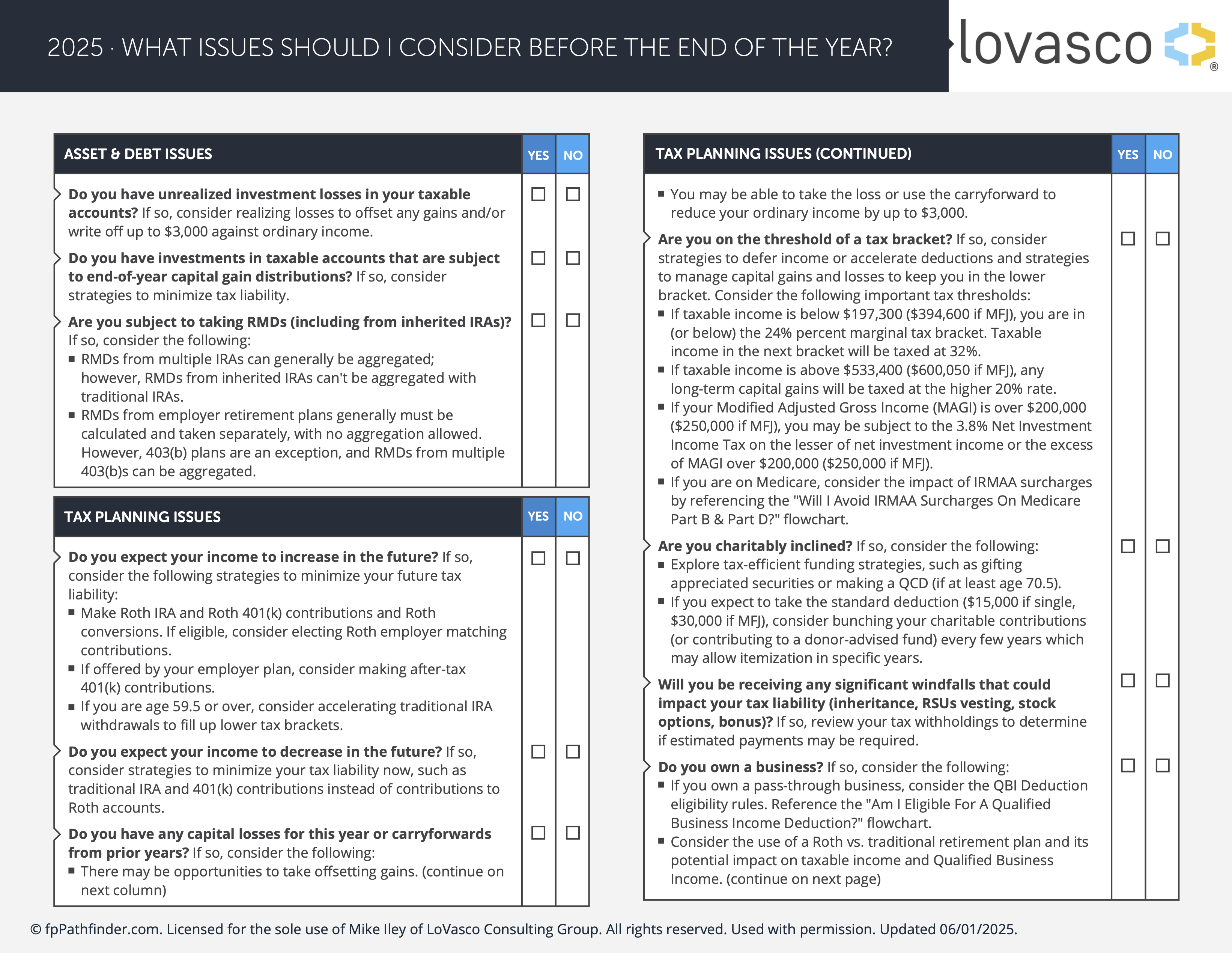

To help you stay on track, we’ve created released this comprehensive resource: “What Issues Should I Consider Before the End of the Year?”

This checklist highlights 18 time-sensitive considerations to review before December 31st, including tax, investment, charitable, cash flow, and estate planning opportunities.

Key Year-End Planning Areas to Review and Consider

1. Tax Planning

Year-end is one of the most effective times to review your tax strategy.

- If your income is near the top of a tax bracket, consider deferring income or accelerating deductions to avoid crossing into a higher rate.

- Harvest losses from underperforming investments to offset capital gains, or even reduce ordinary income by up to $3,000.

- If you expect income changes in future years, Roth conversions or traditional contributions may help balance your tax liability over time.

2. Investments & Retirement Accounts

- Confirm that all required minimum distributions (RMDs) have been taken if applicable.

- Review taxable investment accounts for end-of-year capital gain distributions and plan accordingly.

- If you have an employer retirement plan, see if you can contribute more before year-end, including catch-up contributions, if you’re eligible.

3. Charitable Giving

For those who are charitably inclined, giving strategies can also deliver tax benefits:

- Gifting appreciated securities can reduce both income and capital gains taxes.

- Qualified Charitable Distributions (QCDs) from IRAs (if age 70½+) can count toward RMDs.

- Consider “bunching” contributions into a single year—or funding a donor-advised fund—to maximize deductions.

4. Business Planning

Business owners have unique opportunities:

- Evaluate whether to defer or accelerate expenses to manage taxable income.

- Review eligibility for the Qualified Business Income (QBI) deduction.

- Consider the retirement plan options that must be opened before year-end.

5. Cash Flow & Savings

- If you have extra cash flow, this may be the time to fund a 529 plan for children or grandchildren.

- Review Health Savings Account (HSA) and Flexible Spending Account (FSA) contributions; unused FSA funds may be lost if not spent or rolled over within plan limits.

6. Insurance & Estate Planning

- If you’ve met your health plan deductible, you may want to schedule any outstanding procedures before the reset on January 1, 2026.

- Review your estate plan, particularly if you’ve had life changes such as marriage, divorce, new children, or changes in assets.

- Don’t forget about annual gifting opportunities! Up to $19,000 per person in 2025 can be given gift-tax free.

Why Now Matters

The end of the year is a natural checkpoint to make sure your financial strategies align with your goals. However, you don’t want to wait until the last minute to take measured, strategic action, especially as the holidays near and other end-of-year deadlines emerge. Acting well before December 31st allows you to take advantage of opportunities that disappear once the calendar turns.

Our year-end planning checklist makes it easier to identify which areas deserve your attention. From tax savings to charitable strategies to retirement contributions, a little proactive planning now can pay big dividends in the future, both near and far!

👉 Download the checklist here and let’s schedule a time to review your situation before year-end.

Is Your Retirement Plan Consultant Actually Doing Their Job?

Take the Self-Assessment to Find Out.

You're responsible for your company’s retirement plan. But with shifting regulations, mounting fiduciary risks, and growing employee expectations, how do you know if you have the right fiduciary oversight and financial wellness process in place?

It takes just 3 minutes

It’s completely free

Receive customized results instantly

Not sure where to start?

15 Questions to Score Your Organization's Benefit Program

See what you are missing.

Confirm where you shine.

Track progress over time.

Not sure where to start?

20 Questions to Score Your Organization's Employee Communications Strategy

See what you are missing.

Confirm where you shine.

Track progress over time.

Subscribe to Our Insights Blog

Receive the latest articles from LoVasco's team of experienced experts on employee benefits and retirement plan best practices.