A 2026 Retirement & Tax Planning Tool You’ll Want to Keep Handy

When it comes to retirement and tax planning, it’s often the small details that can make a big difference, so it’s important to pay close attention to the minor changes that take place year to year.

Contribution limits change. Income thresholds shift. New catch-up rules take effect. Medicare premiums and Social Security rules depend on age, earnings, and timing. And many of the most important numbers you need throughout the year don’t live in one easy place.

That’s why having a clear, reliable reference can make a real difference. When you know where to quickly find the figures that guide your decisions, you’re better positioned to take advantage of opportunities, avoid costly mistakes, and have more productive conversations with your advisor.

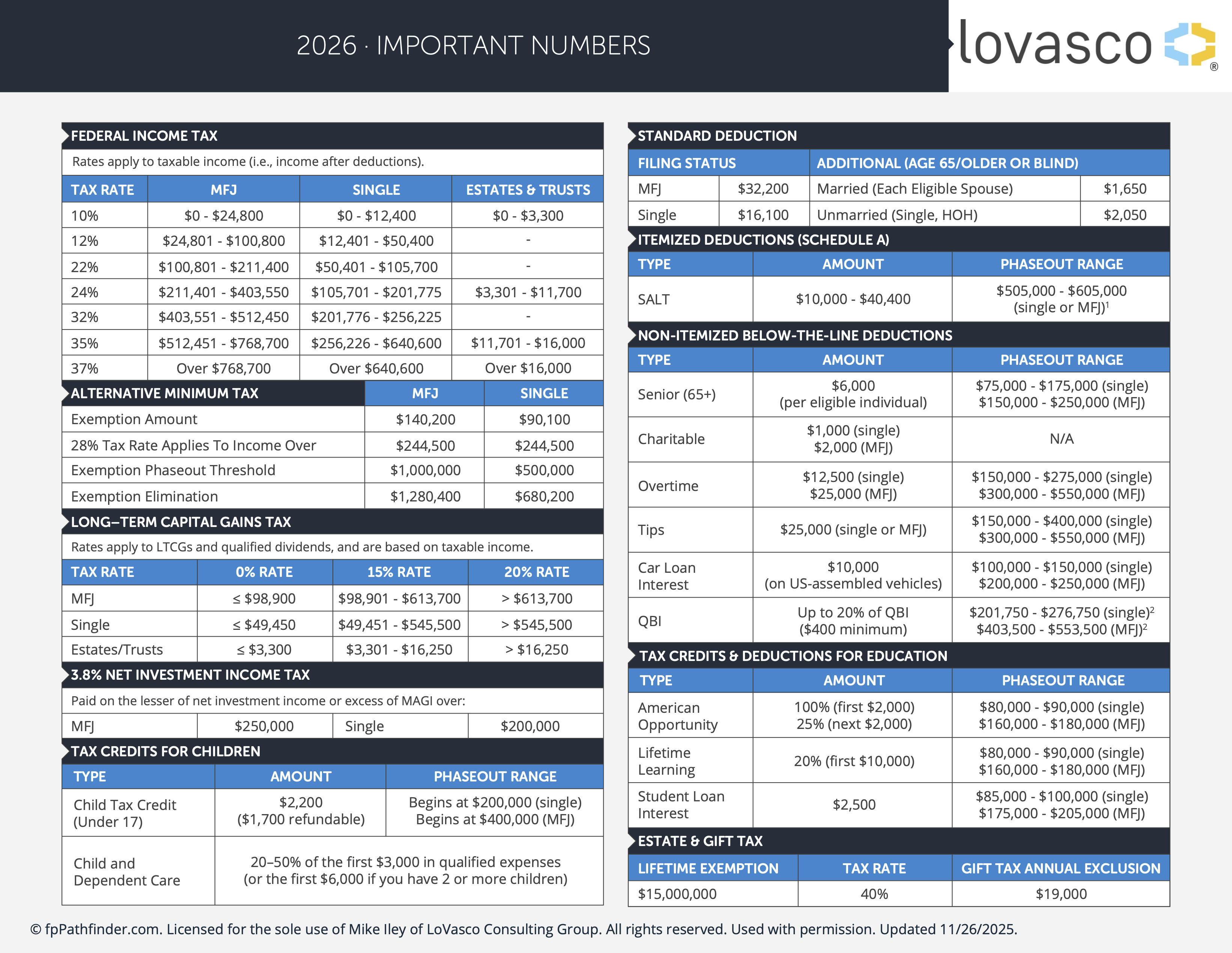

To help simplify that process, LoVasco Consulting Group is sharing an updated 2026 Important Numbers Guide—a concise, two-page PDF designed to put the most commonly referenced retirement, tax, and benefits figures in one place.

Why a Quick Reference Matters More Than You Think

Most people don’t need to memorize tax brackets or contribution limits—but they do need to know when a number applies to them.

Should you increase your 401(k) deferral this year? Are you eligible for catch-up contributions? Does a raise affect your ability to contribute to a Roth IRA? Will higher income trigger Medicare premium surcharges down the road?

These questions tend to come up at specific moments—during open enrollment, at bonus time, when filing taxes, or as retirement gets closer. Having a trusted reference at hand helps you answer those questions more confidently and act sooner rather than later.

What You’ll Find in the 2026 Important Numbers Guide

The guide brings together the figures individuals most commonly ask about during the year, including:

- Retirement plan contribution limits for 401(k), 403(b), and 457 plans, along with standard catch-up contributions for those age 50+ and enhanced catch-up limits for individuals ages 60–63. These limits can meaningfully impact how much you’re able to save during your peak earning years.

- IRA and Roth IRA contribution rules, including income phaseouts that determine eligibility. As income changes, these thresholds become increasingly important for deciding where—and how—to save.

- Health Savings Account (HSA) and Flexible Spending Account limits, which often represent overlooked opportunities to save on a tax-advantaged basis while covering current or future healthcare expenses.

- Social Security and Medicare reference points, such as full retirement age, earnings limits before FRA, Medicare Part B premiums, and IRMAA surcharge thresholds tied to prior-year income. These numbers play a critical role in retirement timing and income planning.

- Key tax figures, including federal income tax brackets, long-term capital gains rates, standard deductions, estate and gift tax exclusions, and qualified charitable distribution limits—helpful context when coordinating retirement income with tax strategy.

Rather than replacing personalized advice, the guide serves as a practical companion—helping you understand the guardrails around your planning decisions.

How to Use This Guide in Your Own Planning

Think of this resource as a planning touchstone. You might refer to it when:

- Deciding whether to increase retirement contributions

- Evaluating whether a Roth strategy still makes sense

- Planning for healthcare costs before and during retirement

- Anticipating how income may affect taxes or Medicare premiums

- Preparing for conversations with your advisor

Used this way, the guide helps turn complex rules into manageable decisions.

Knowledge Builds Confidence—and Better Outcomes

At LoVasco Consulting Group, we believe that informed individuals make better financial decisions.

When you understand the numbers that shape your retirement and tax strategy, you’re more likely to stay engaged, adjust proactively, and feel confident about the path you’re on. Over time, that engagement leads to better outcomes—not just financially, but in the mental clarity that comes with knowing you’re making intentional choices.

We encourage you to download and keep the 2026 Important Numbers Guide accessible throughout the year. It’s a simple tool, but one that can support smarter, more confident planning at every stage of your financial journey.

Is Your Retirement Plan Consultant Actually Doing Their Job?

Take the Self-Assessment to Find Out.

You're responsible for your company’s retirement plan. But with shifting regulations, mounting fiduciary risks, and growing employee expectations, how do you know if you have the right fiduciary oversight and financial wellness process in place?

It takes just 3 minutes

It’s completely free

Receive customized results instantly

Not sure where to start?

15 Questions to Score Your Organization's Benefit Program

See what you are missing.

Confirm where you shine.

Track progress over time.

Not sure where to start?

20 Questions to Score Your Organization's Employee Communications Strategy

See what you are missing.

Confirm where you shine.

Track progress over time.

Subscribe to Our Insights Blog

Receive the latest articles from LoVasco's team of experienced experts on employee benefits and retirement plan best practices.